- #CANADIAN TAX SOFTWARE REVIEWS PLUS#

- #CANADIAN TAX SOFTWARE REVIEWS DOWNLOAD#

- #CANADIAN TAX SOFTWARE REVIEWS FREE#

#CANADIAN TAX SOFTWARE REVIEWS PLUS#

You get all the perks of the basic package, plus the ability to see how your taxes will change when your life does. If you want the most bang for your buck when it comes to deductions, this is the package for you. ( Learn more about the Basic edition.) TurboTax Online Deluxe ($29.95)

#CANADIAN TAX SOFTWARE REVIEWS FREE#

( Learn more about the Free Edition.) TurboTax Online Basic ($19.95) The Free edition is for those with simple returns (1040EZ, 1040A, and 1040) who can do the return themselves without the step-by-step guidance that paid editions of TurboTax offers. Whatever your situation, there’s a package for you. Some people are beginners and need help step-by-step, others have additional properties that may need more detail.

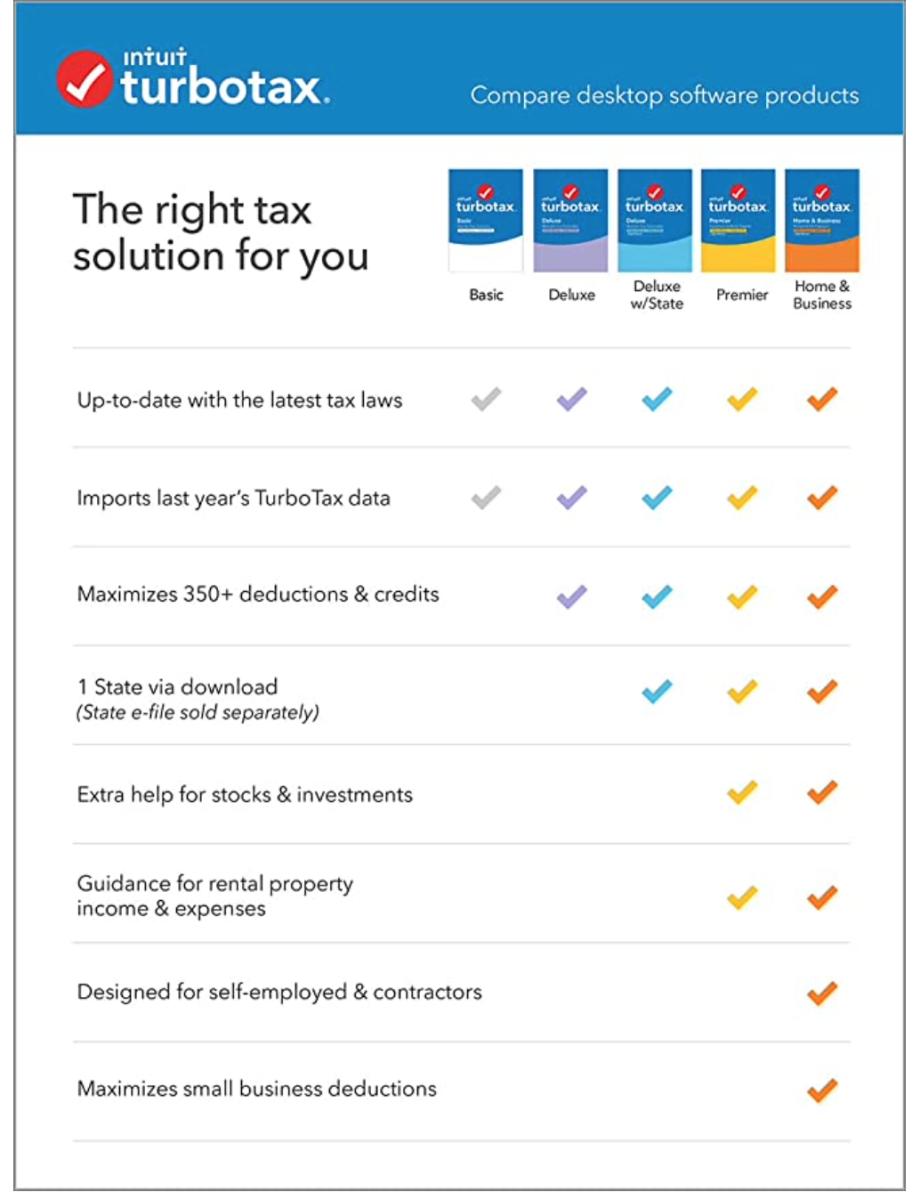

You can start them all for free, and choose which one works best for you, and pay when you file. You can choose between five TurboTax packages: Free Edition, Basic, Deluxe, Premier, and Home & Business. If you do have a bank account, you can deposit your refund in up to three accounts. When it comes to your refund, you have the option to deposit some or all of your refund deposited onto a prepaid debit card, the TurboTax Refund Card, which is helpful if you don’t have a bank account.

#CANADIAN TAX SOFTWARE REVIEWS DOWNLOAD#

There’s also a download available to guide you through the process in case the IRS calls you.

Keeps you informed as to how much you’re saving every time you add a deduction or credit.All the tax laws have been updated in the system.Recommendations for what you should deduct or credits based on your personal situation.Yes, they’re still the GPS for your taxes, guiding you through the entire process. Any income you received in interest, thanks to the integration with.Info from last year’s tax return, even if it was prepared using different software.Your earnings and account information from your job, bank or credit union.They take out the hassle of manually entering your information by automatically filling in: TurboTax 2010 is all about making things easier and more accurate this year. No Easier, Faster Way to Get Your Biggest Possible Tax Refund – How so?

0 kommentar(er)

0 kommentar(er)